A first look

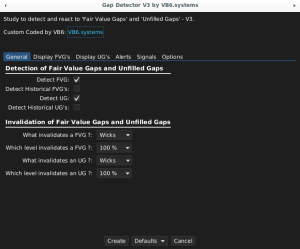

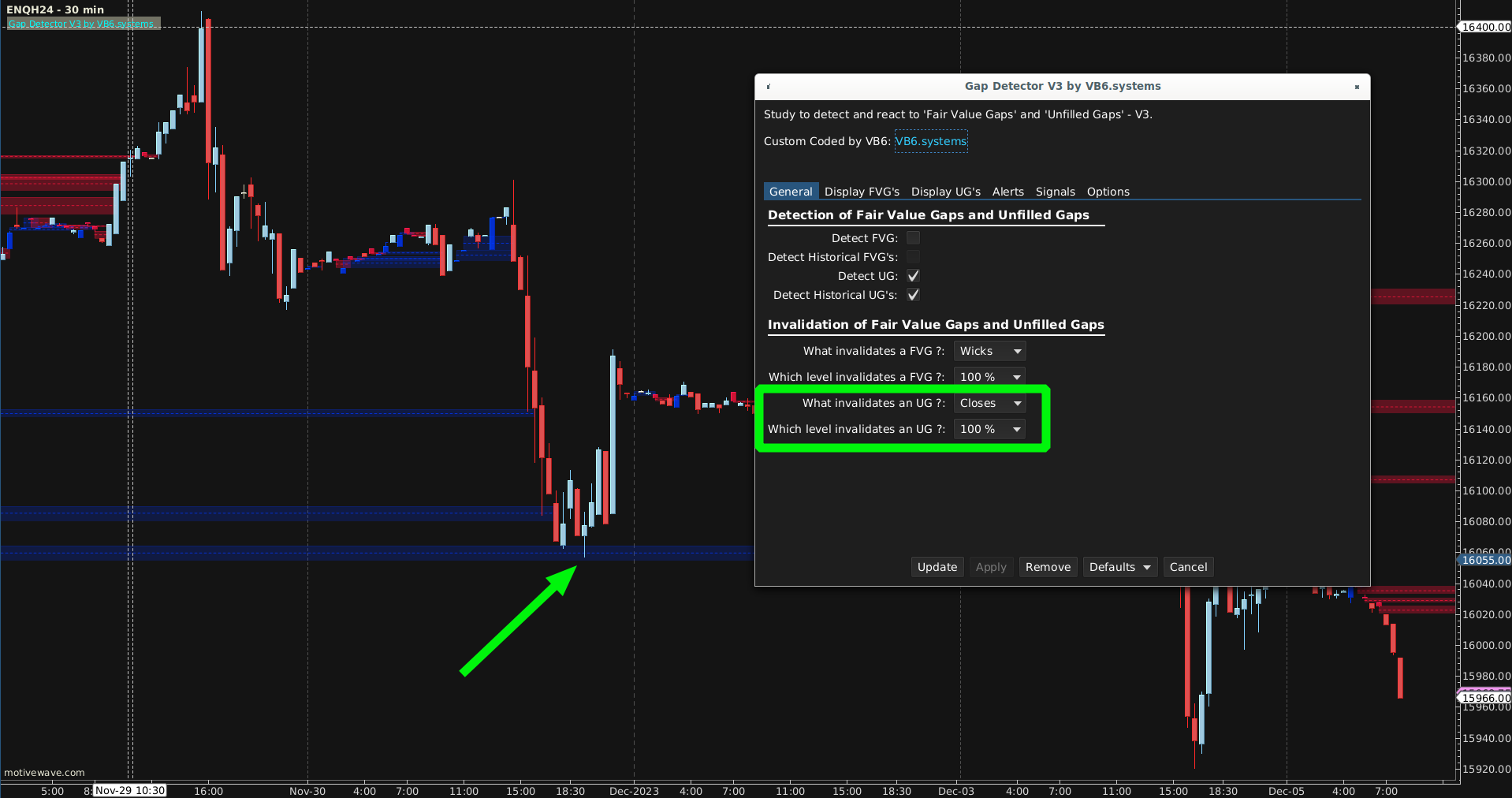

This Study will find both ‘Fair Value Gaps’ and ‘Unfilled Gaps’, mark them and allow a user to set alerts when a gap is touched or invalidated.

Furthermore, a user can select which level of a candle invalidates a gap (the high / low aka the ‘wick’ or the close) and at which level a gap should be invalidated (25 %, 50%, 75% or 100%).

Click on the images to enlarge

Click on the images to enlarge

What’s included ?

- Detection of ‘Fair Value Gaps’, defined as “the low of the current bar does not overlap the high of 2 bars before” or “the high of the current bar does not overlap the low of 2 bars before”. Works particularly well for Forex & indices.

- Detection of ‘Unfilled Gaps’, defined as “the gap that exists between last bar’s close and this bar’s open”. Perfect for Futures, stocks, ETF, crypto, ….

- A user can select to show only the Gaps that have not been invalidated yet, or also display the historical ones.

- A user can select which level of a candle invalidates a Gap: either the High/Low (aka the ‘Wick’) or the Close

- A user can also select at which level a Gap should be invalidated: 25% of its total size, 50 %, 75% or 100%

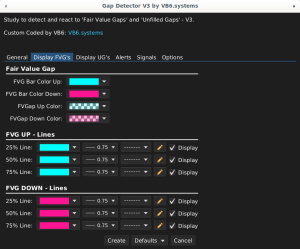

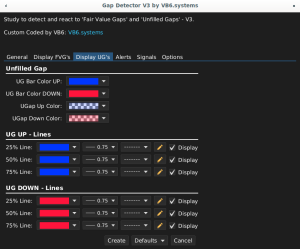

- The colors of the Bars creating a Gap are fully customizable, along with the colors of the Gaps themselves.

- Weight, style and color of the levels inside a Gap can also be adjusted according to taste (and chart background!)

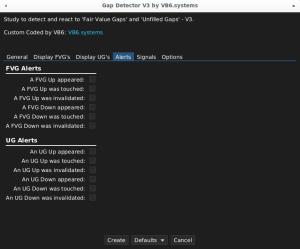

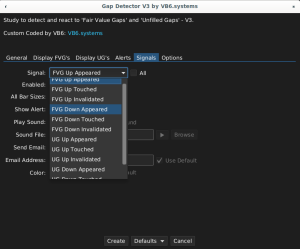

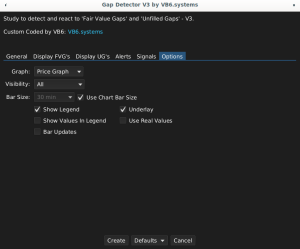

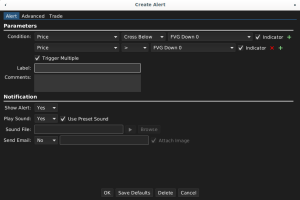

- A user can chose to set alarms for 3 kinds of events, for both Fair Value Gaps and Unfilled Gaps: a Gap (up or down) appeared, a Gap was touched, a Gap was invalidated (according to your own ruleset).

- A user can also use all those alert-values to set MW-alerts, thus creating semi-automated trade setups:

Click on the image to enlarge

- Last but not least: all these alerts can also be translated into ‘Signals’, allowing time away from the screen (MW will send an email) or the creation of a MW-Strategy, based on Gaps. Creation, Testing and backtesting of Strategies with Strategy Builder (by TradingIndicators.com) is also possible (all GapDetector-values are exported to the Cursor Data Window, so can be selected in Strategy Builder).

- It’s all there

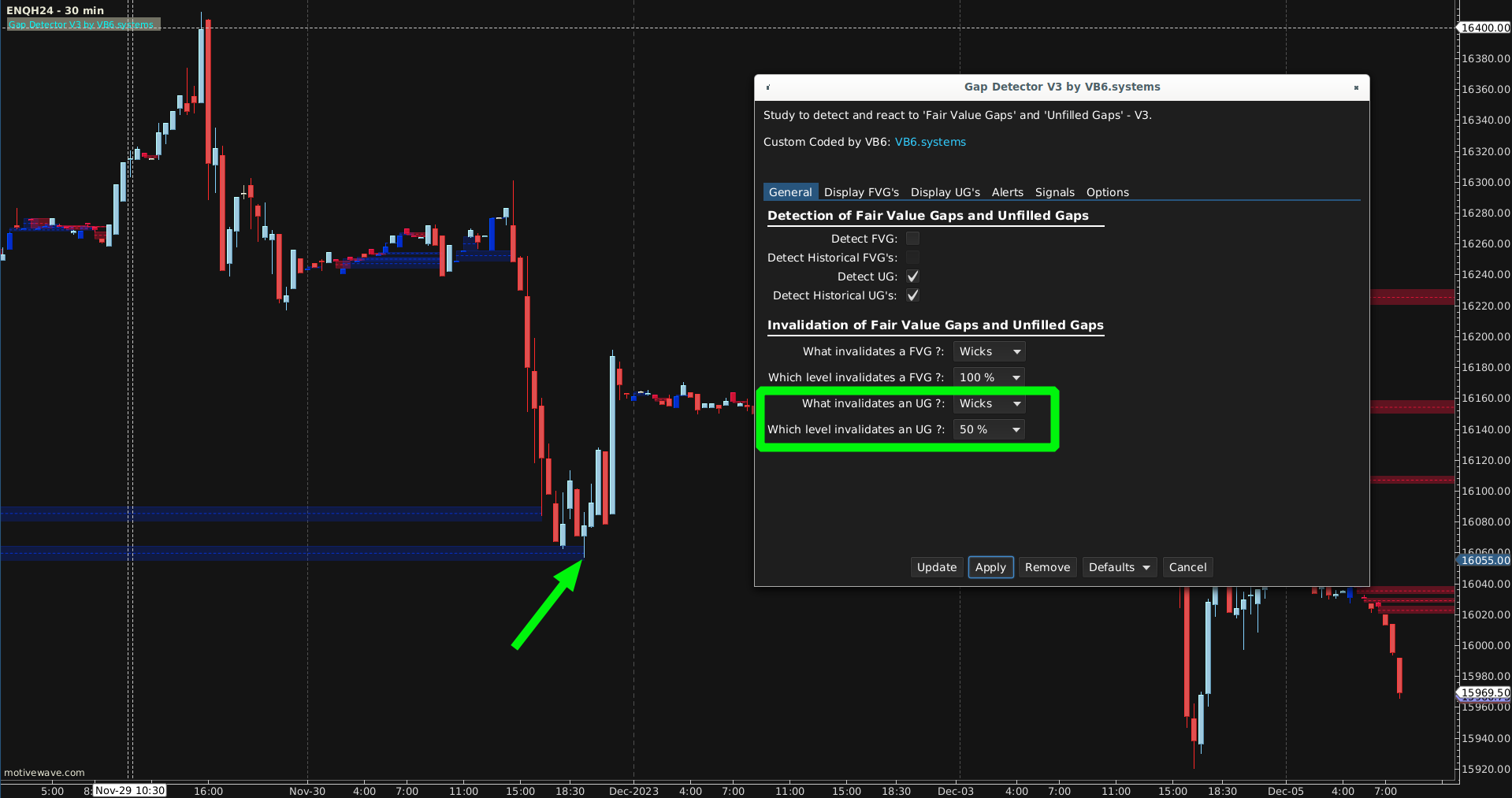

A deeper dive: The ‘Invalidation’ Options

Consider the following ‘ENQ’-chart: the GapDetector is set to only invalidate a Gap when a candle closes below the 100%-level of an upwards FVGap. The Low of a candle reaches only below the 50%-level, so the Gap stays ‘alive’: it will continue to be drawn on the chart.

In the next chart, the user decided to invalidate the FVGaps when the Low ‘wicks’ below the 50%-level, and it does, so the Gap is invalidated:

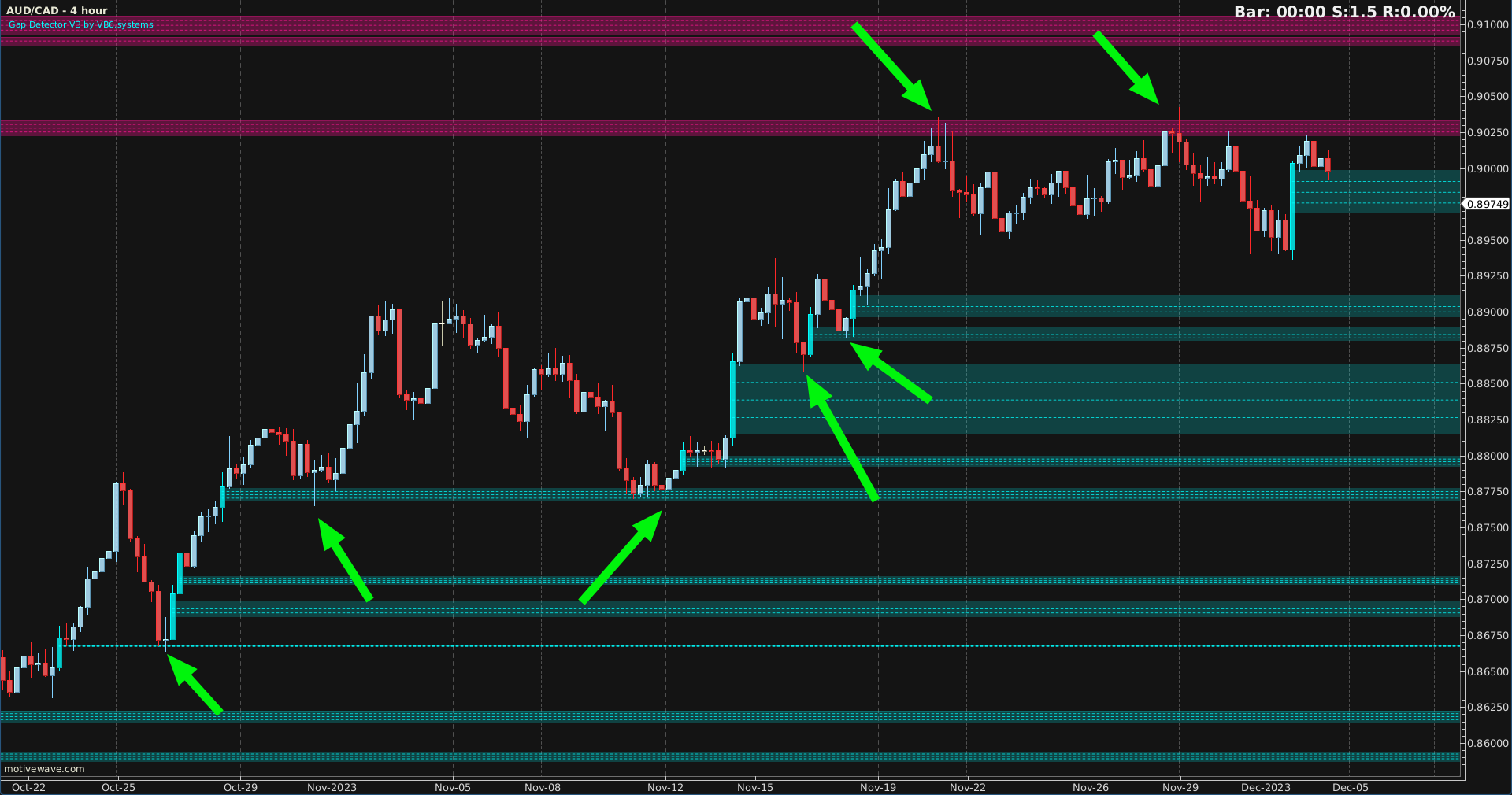

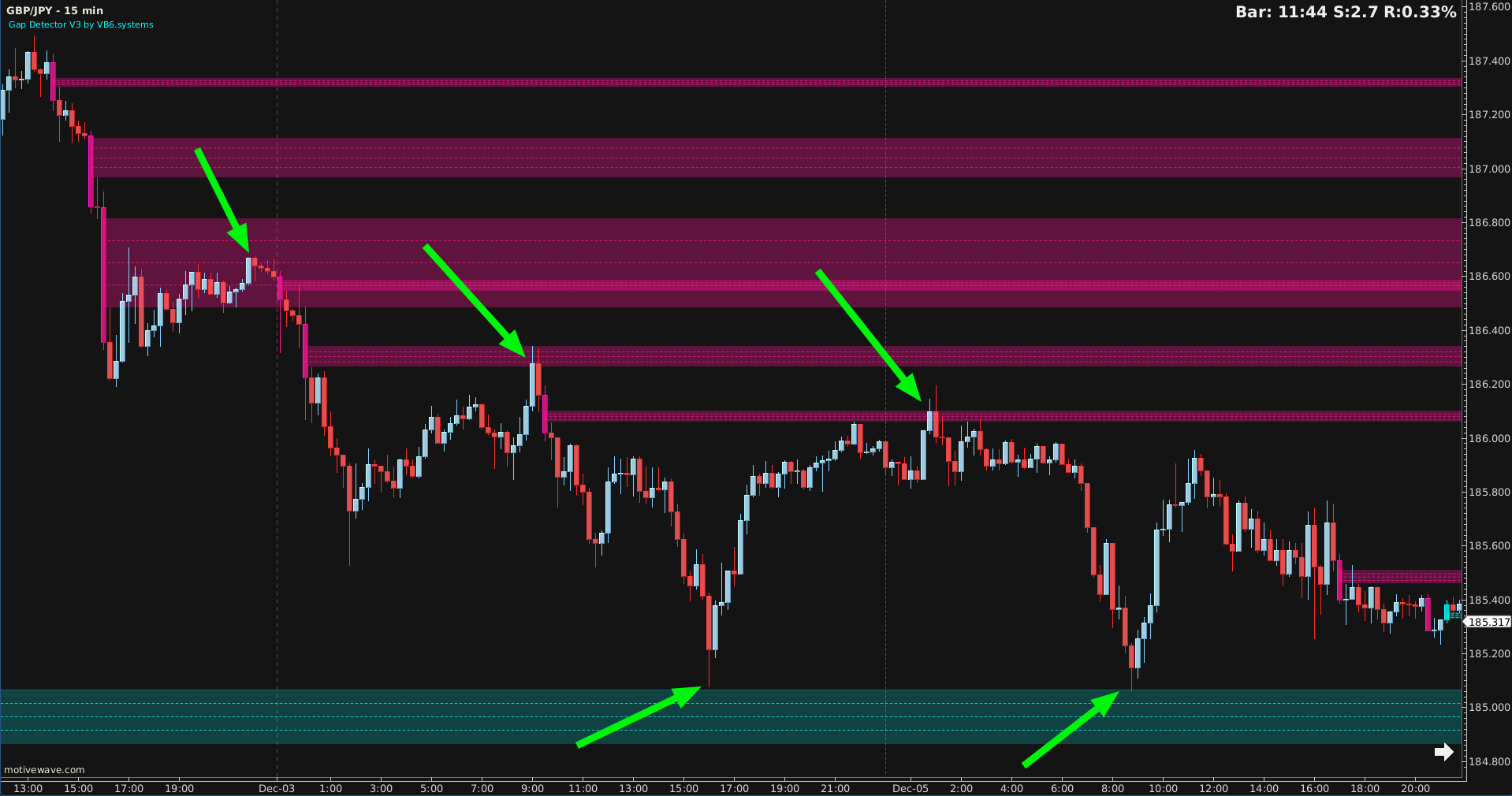

How does Spin use this wonderful indicator ?

Personally, I am a big fan of FVGaps on Forex-charts. Regardless of the timeframe, the candles almost always react nicely to those levels:

How to import the GapDetector V3 into the MotiveWave Platform ?

We have this covered in our FAQ. Please click here