GapDetector V3

“Because all charts dance to the tune of Gaps”

We have this covered in our FAQ. Please click here

In the next chart, the user decided to invalidate the FVGaps when the Low ‘wicks’ below the 50%-level, and it does, so the Gap is invalidated:

How to import the GapDetector into the MotiveWave Platform ?

We have this covered in our FAQ. Please click here

[/vc_column_text][/vc_column][/vc_row]

click the images to enlarge

What’s included ?

-

-

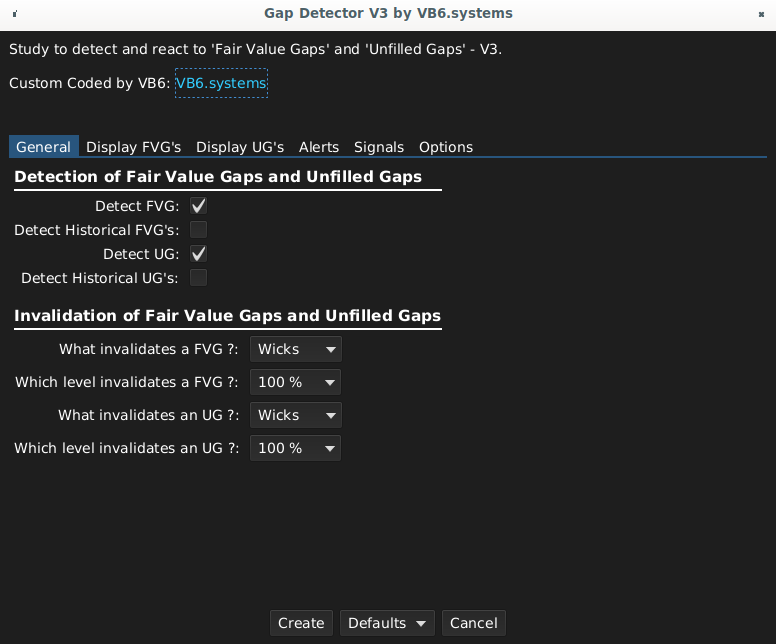

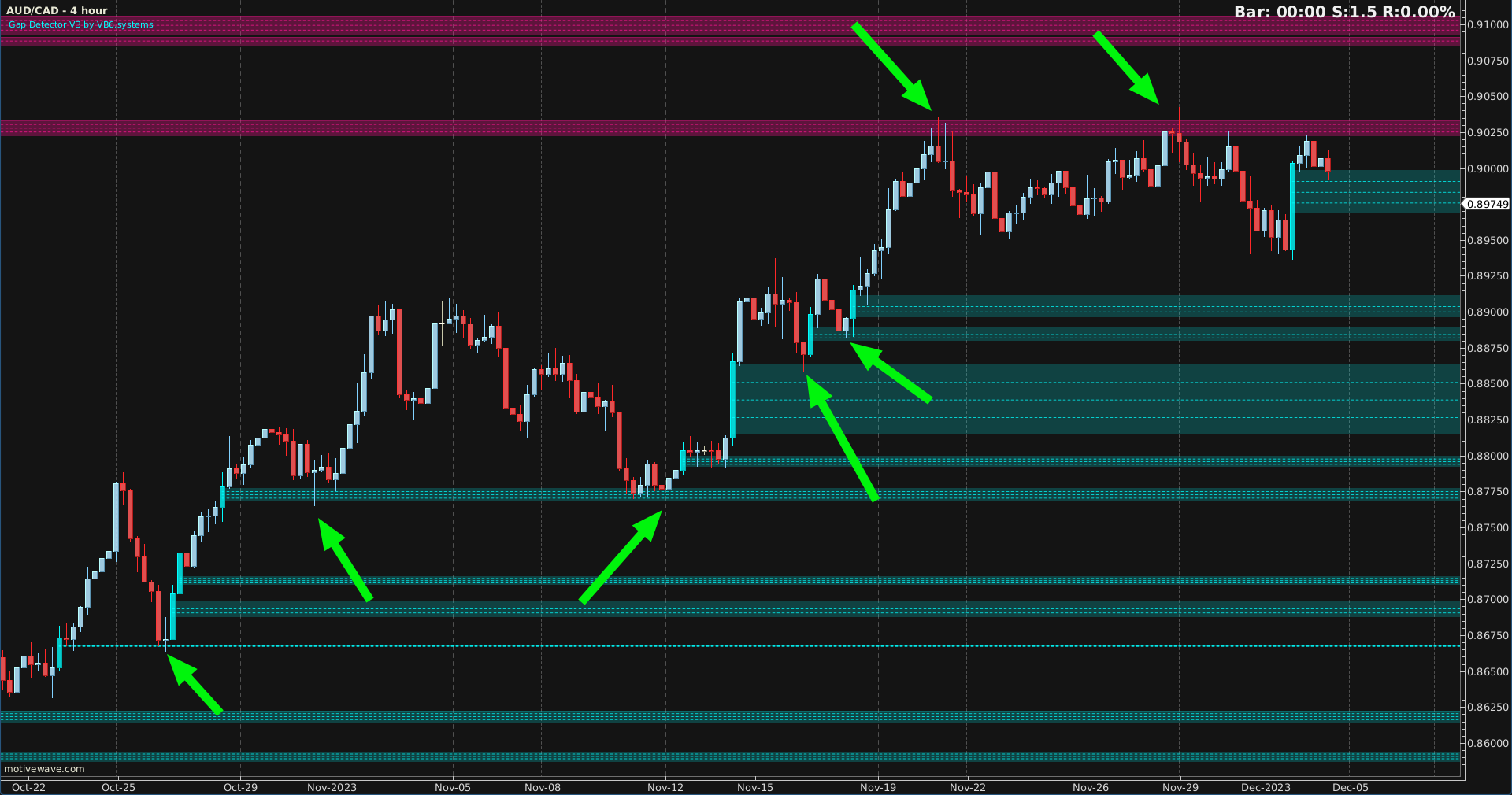

- Detection of ‘Fair Value Gaps’, defined as “the low of the current bar does not overlap the high of 2 bars before” or “the high of the current bar does not overlap the low of 2 bars before”. Works particularly well for Forex & indices.

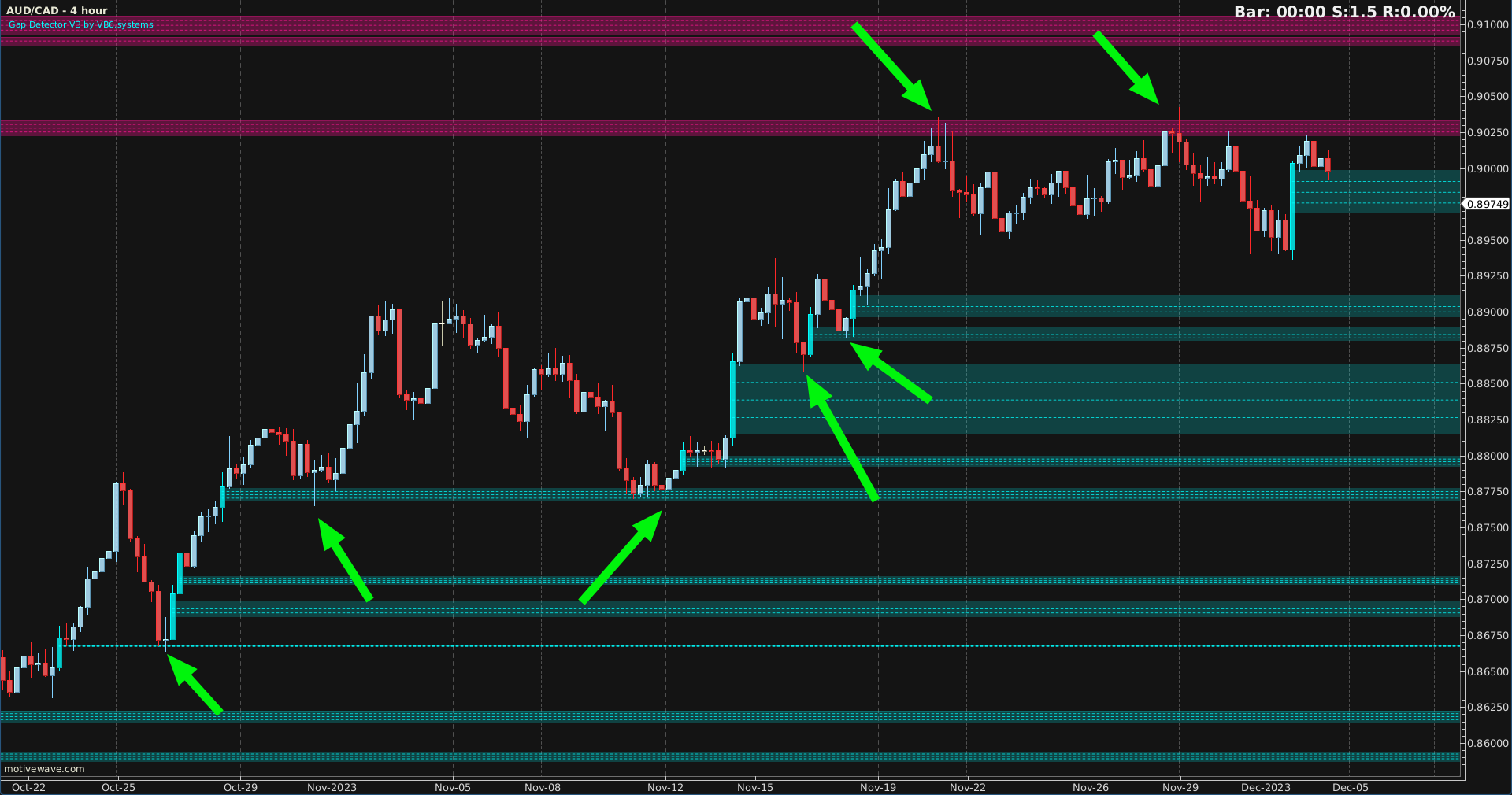

- Detection of ‘Unfilled Gaps’, defined as “the gap that exists between last bar’s close and this bar’s open”. Perfect for Futures, stocks, ETF, crypto, ….

- A user can select to show only the Gaps that have not been invalidated yet, or also display the historical ones.

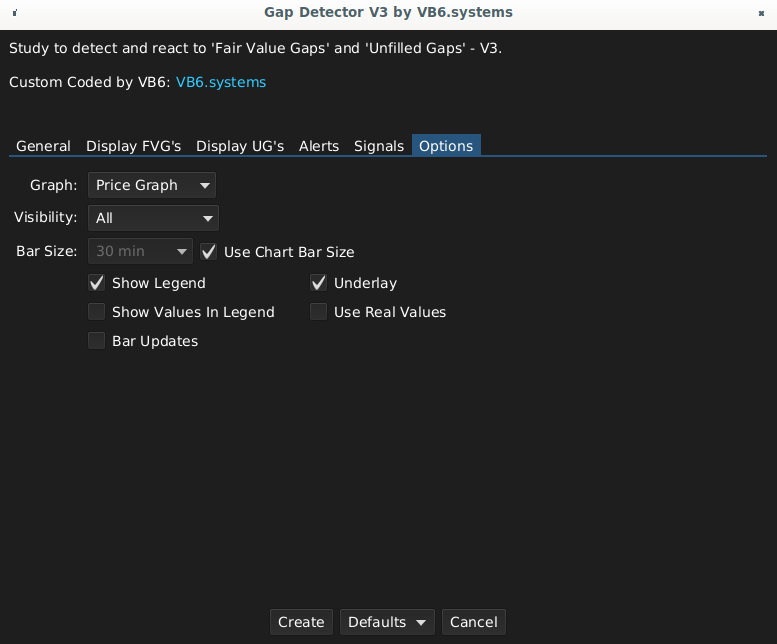

- A user can select which level of a candle invalidates a Gap: either the High/Low (aka the ‘Wick’) or the Close

- A user can also select at which level a Gap should be invalidated: 25% of its total size, 50 %, 75% or 100%

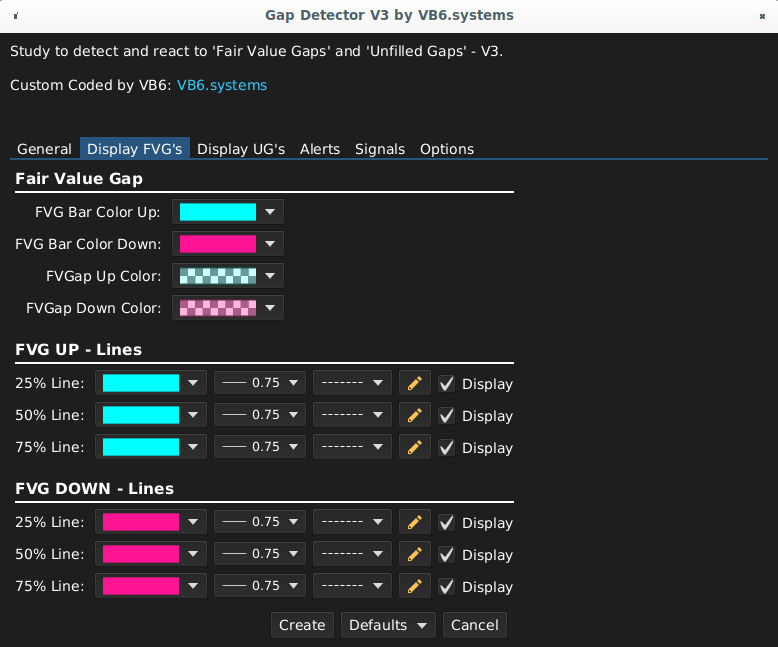

- The colors of the Bars creating a Gap are fully customizable, along with the colors of the Gaps themselves.

- Weight, style and color of the levels inside a Gap can also be adjusted according to taste (and chart background!)

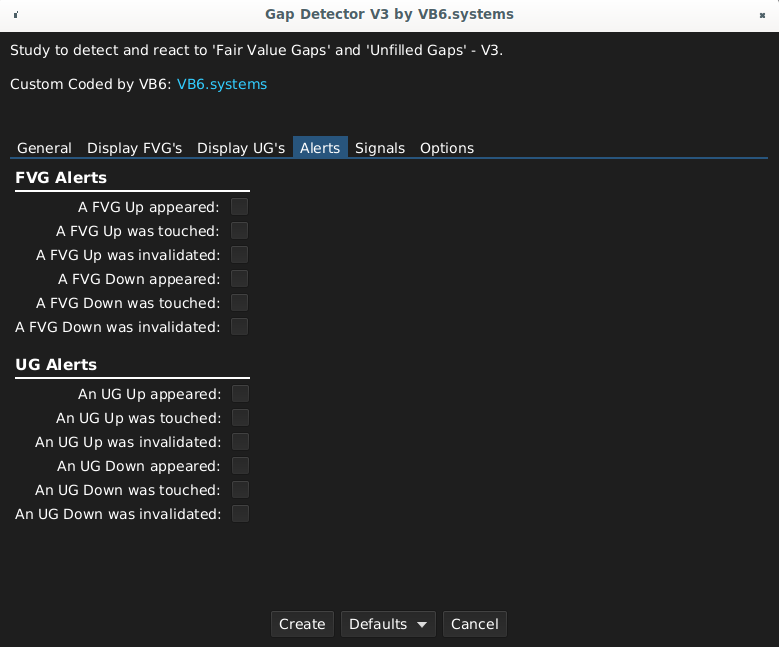

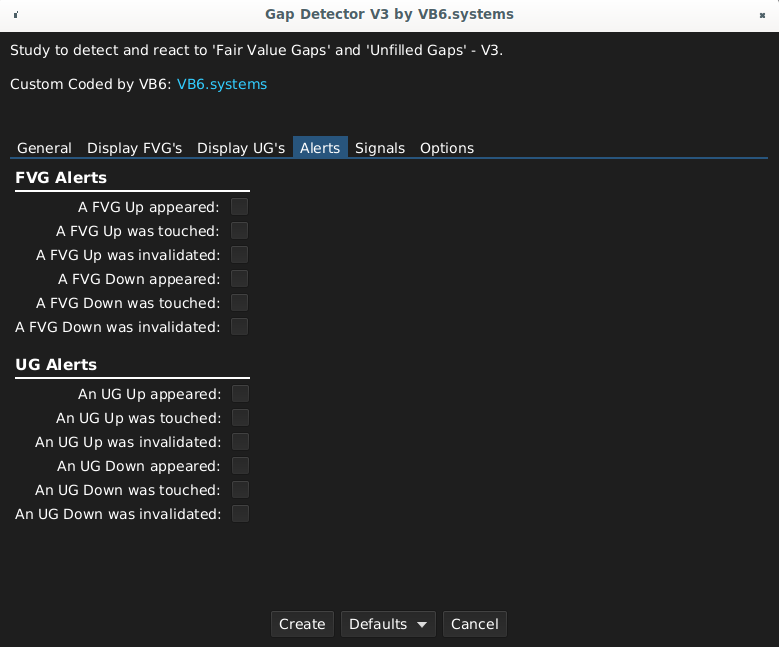

- A user can chose to set alarms for 3 kinds of events, for both Fair Value Gaps and Unfilled Gaps: a Gap (up or down) appeared, a Gap was touched, a Gap was invalidated (according to your own ruleset).

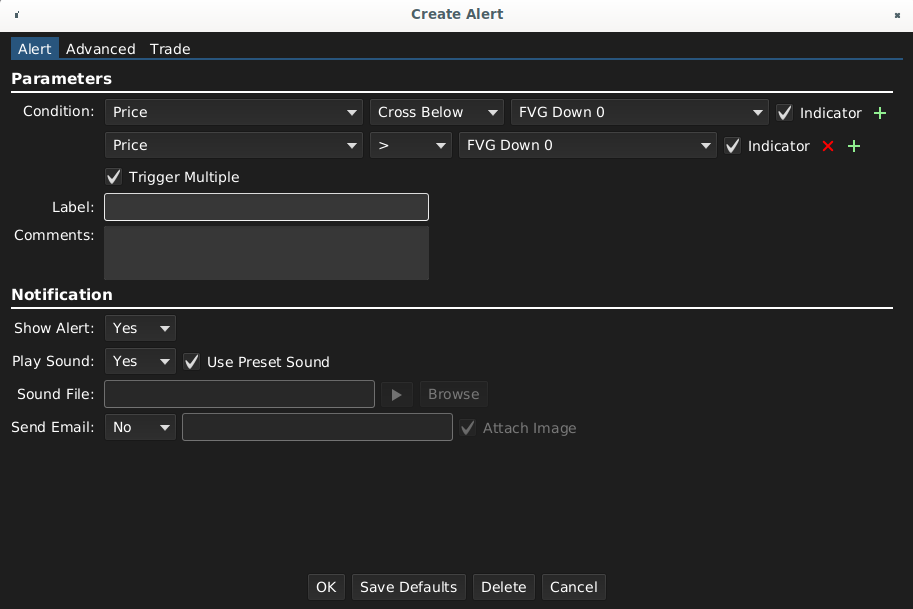

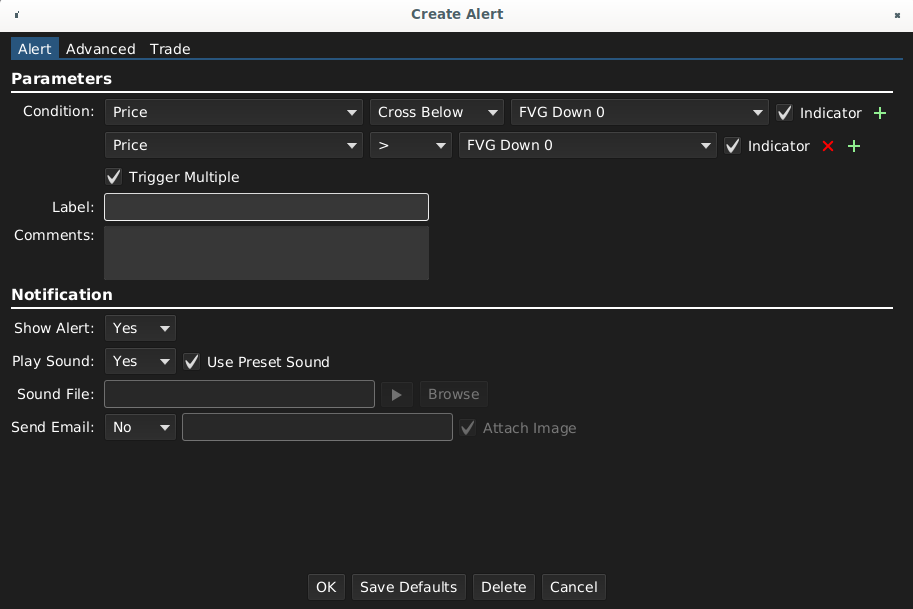

- A user can also use all those alert-values to set MW-alerts, thus creating semi-automated trade setups:

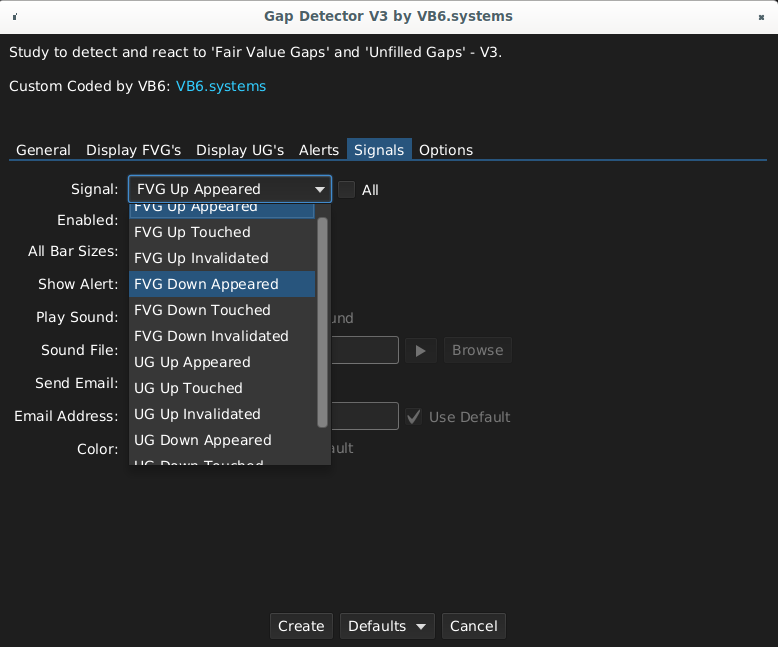

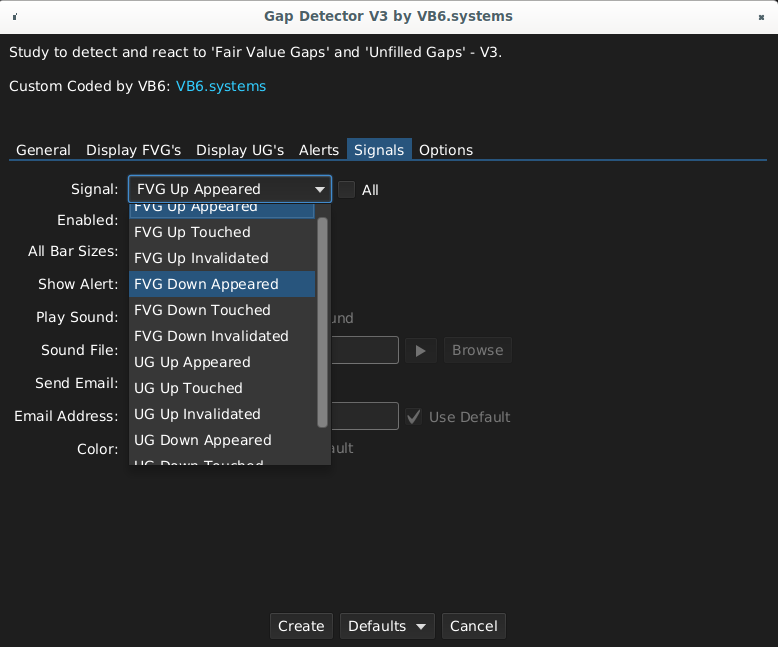

- Last but not least: all these alerts can also be translated into ‘Signals’, allowing time away from the screen (MW will send an email) or the creation of a MW-Strategy, based on Gaps. Creation, Testing and backtesting of Strategies with Strategy Builder (by TradingIndicators.com) is also possible (all GapDetector-values are exported to the Cursor Data Window, so can be selected in Strategy Builder).

- It’s all there !

-

[/vc_column_text][/vc_column][/vc_row]

-

A deeper dive

The ‘Invalidation Options’

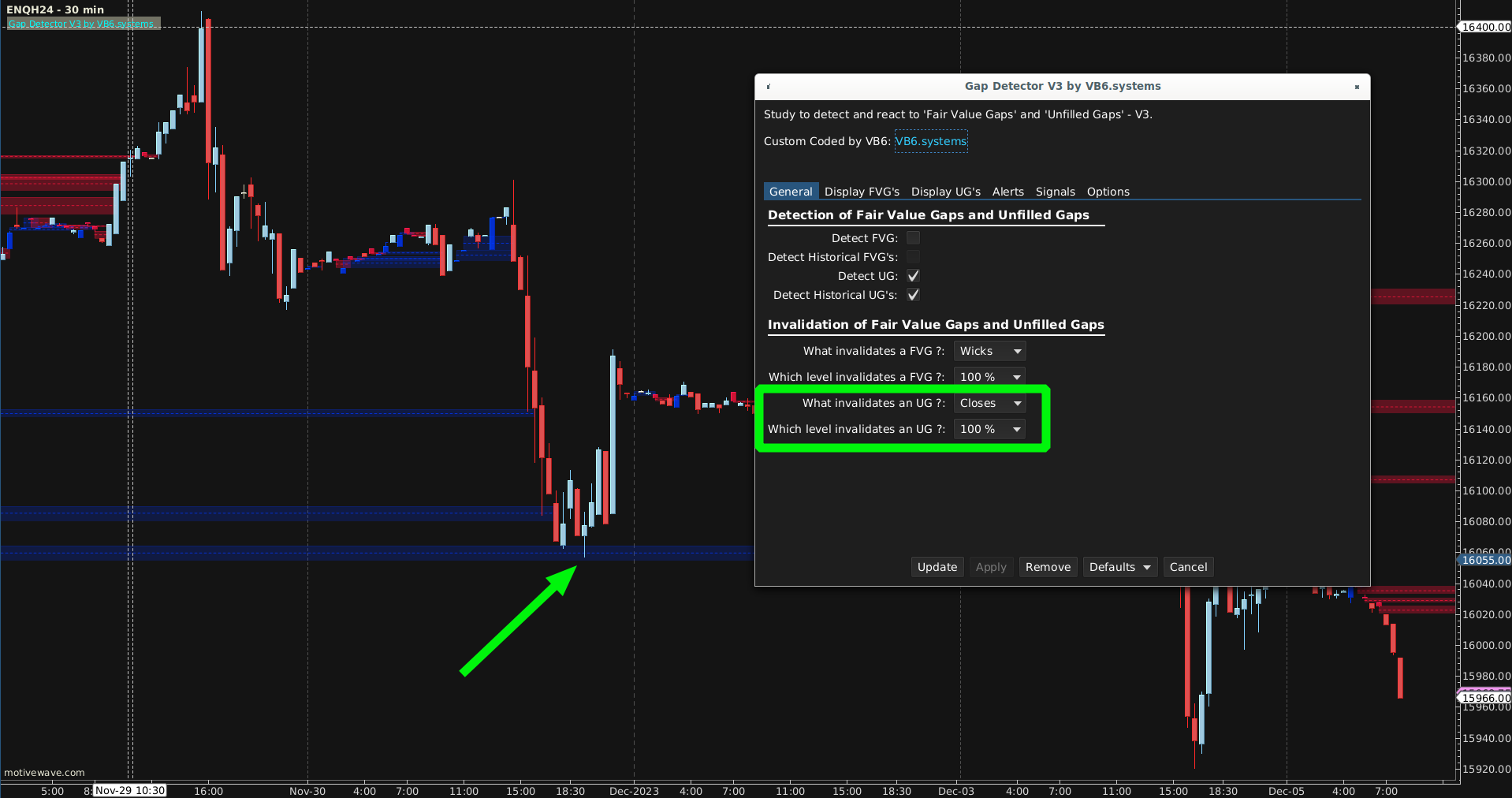

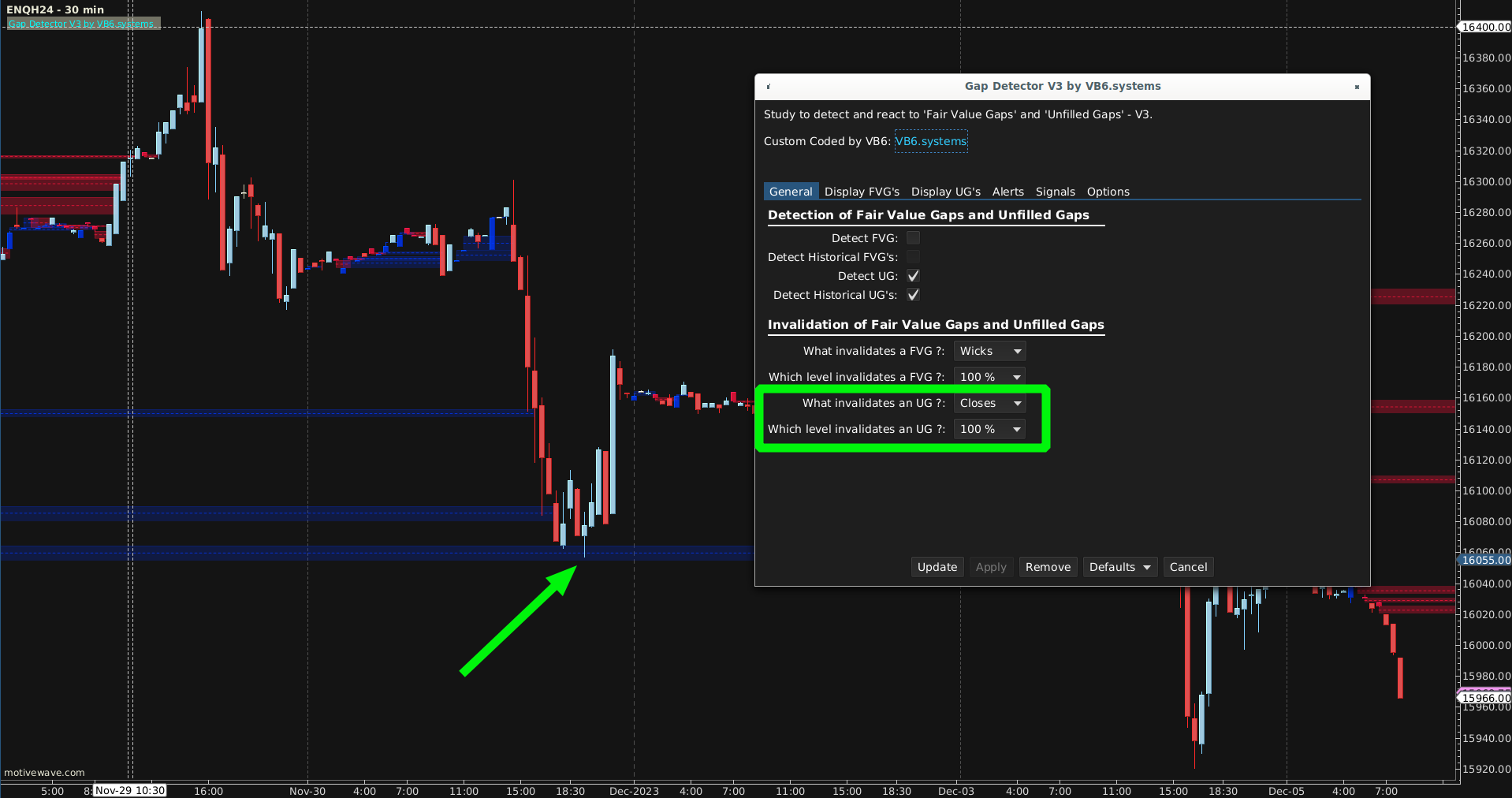

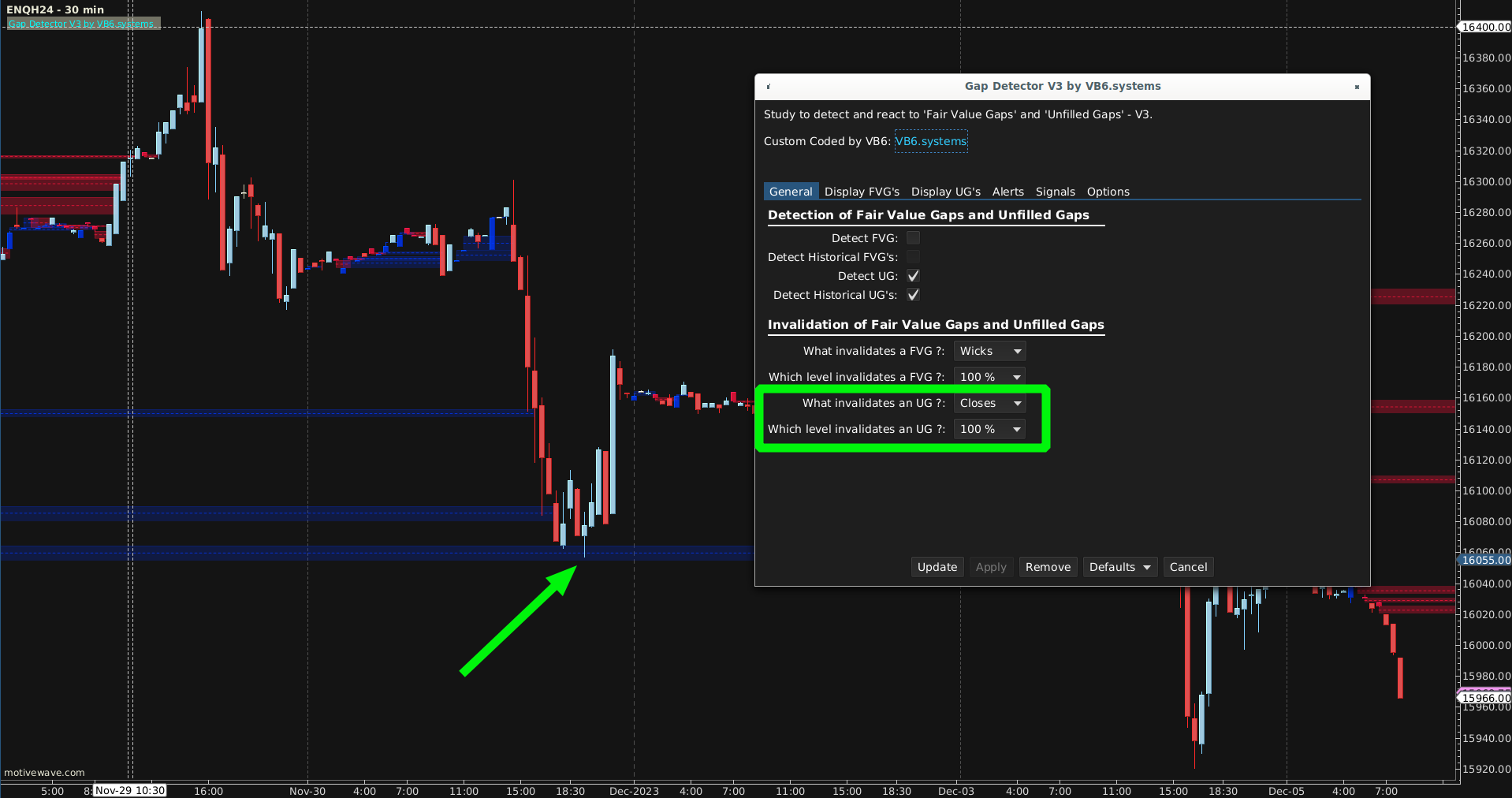

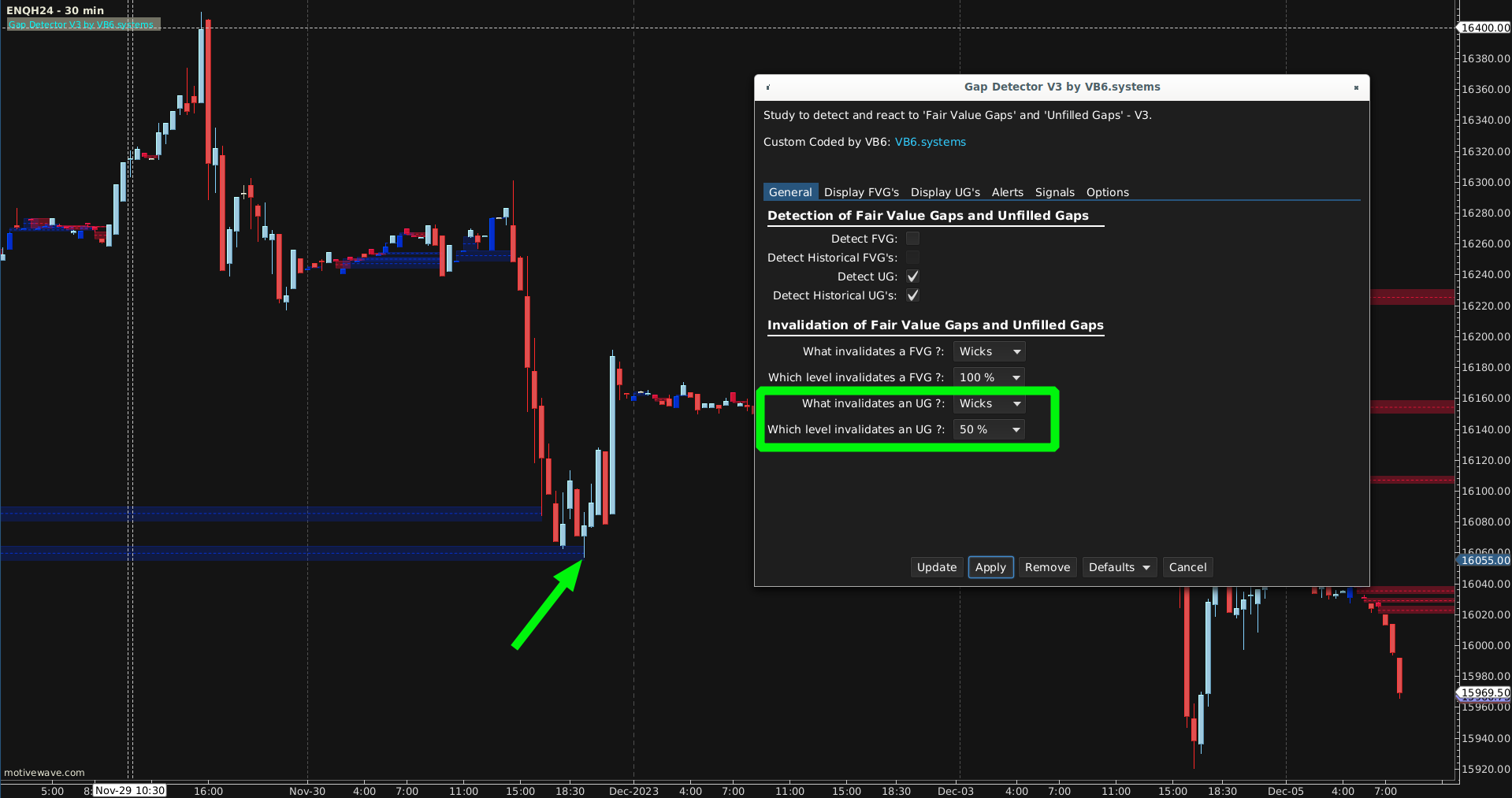

Consider the following ‘ENQ’-chart: the GapDetector is set to only invalidate a Gap when a candle closes below the 100%-level of an upwards FVGap. The Low of a candle reaches only below the 50%-level, so the Gap stays ‘alive’: it will continue to be drawn on the chart.

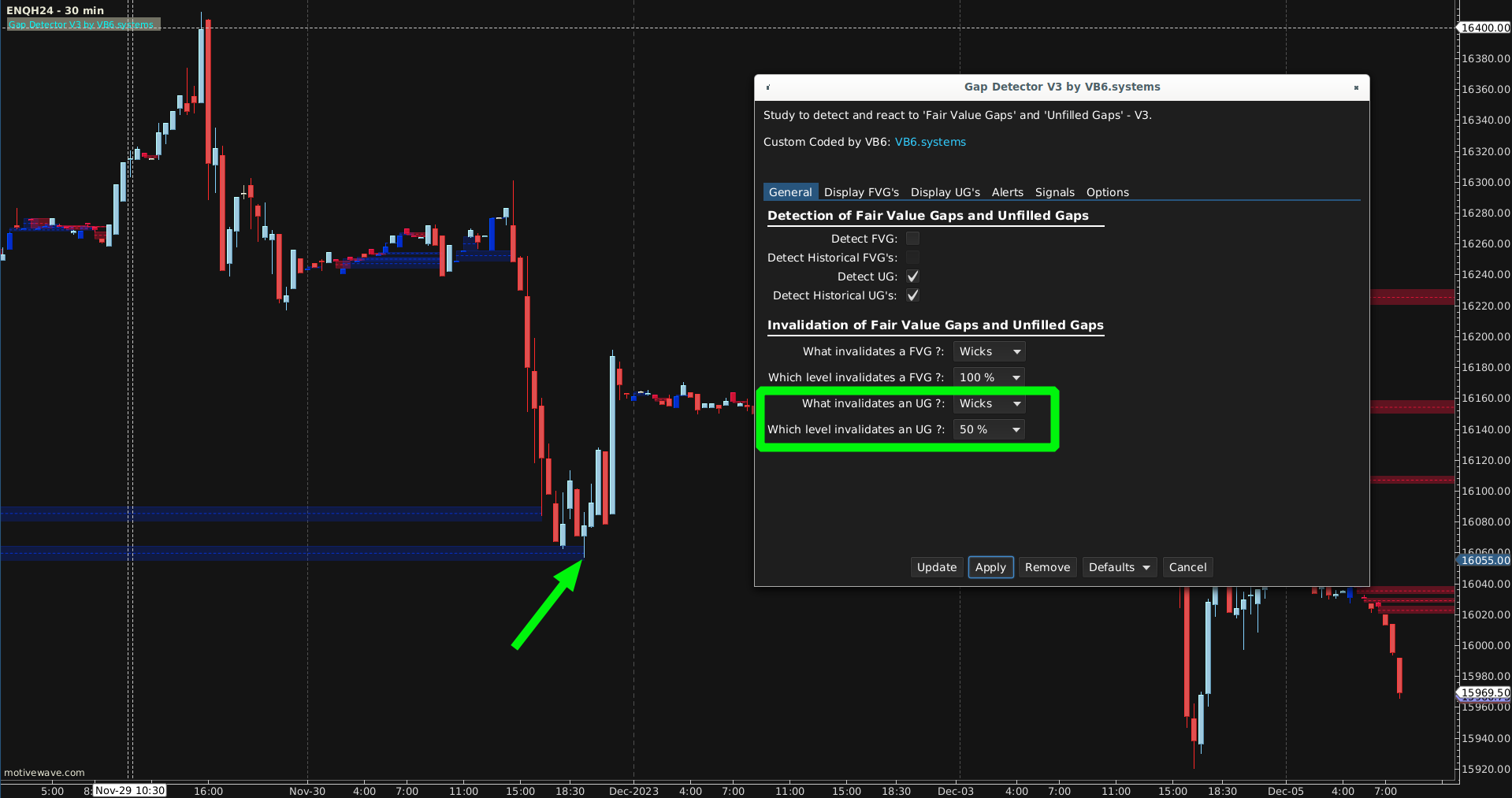

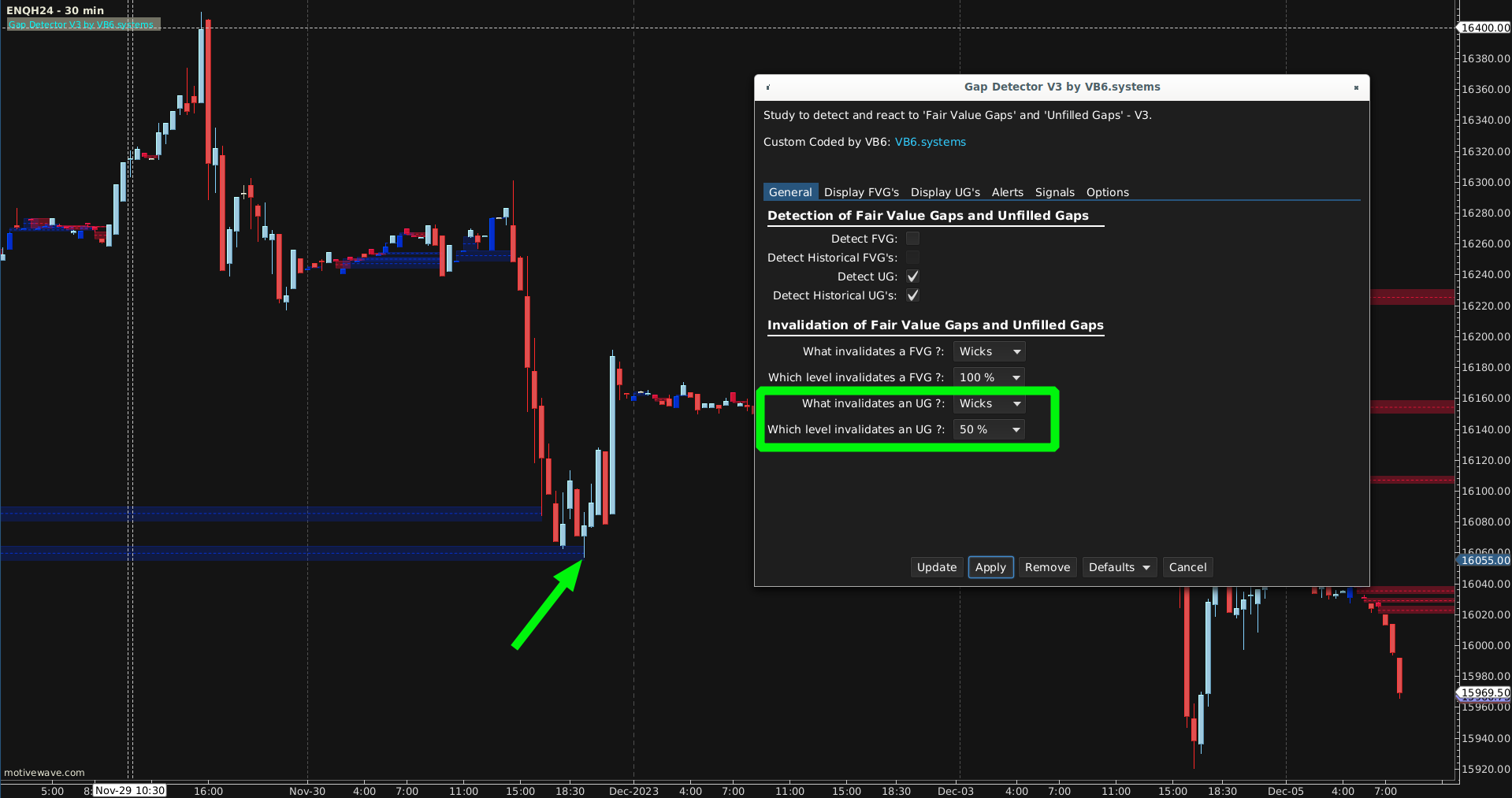

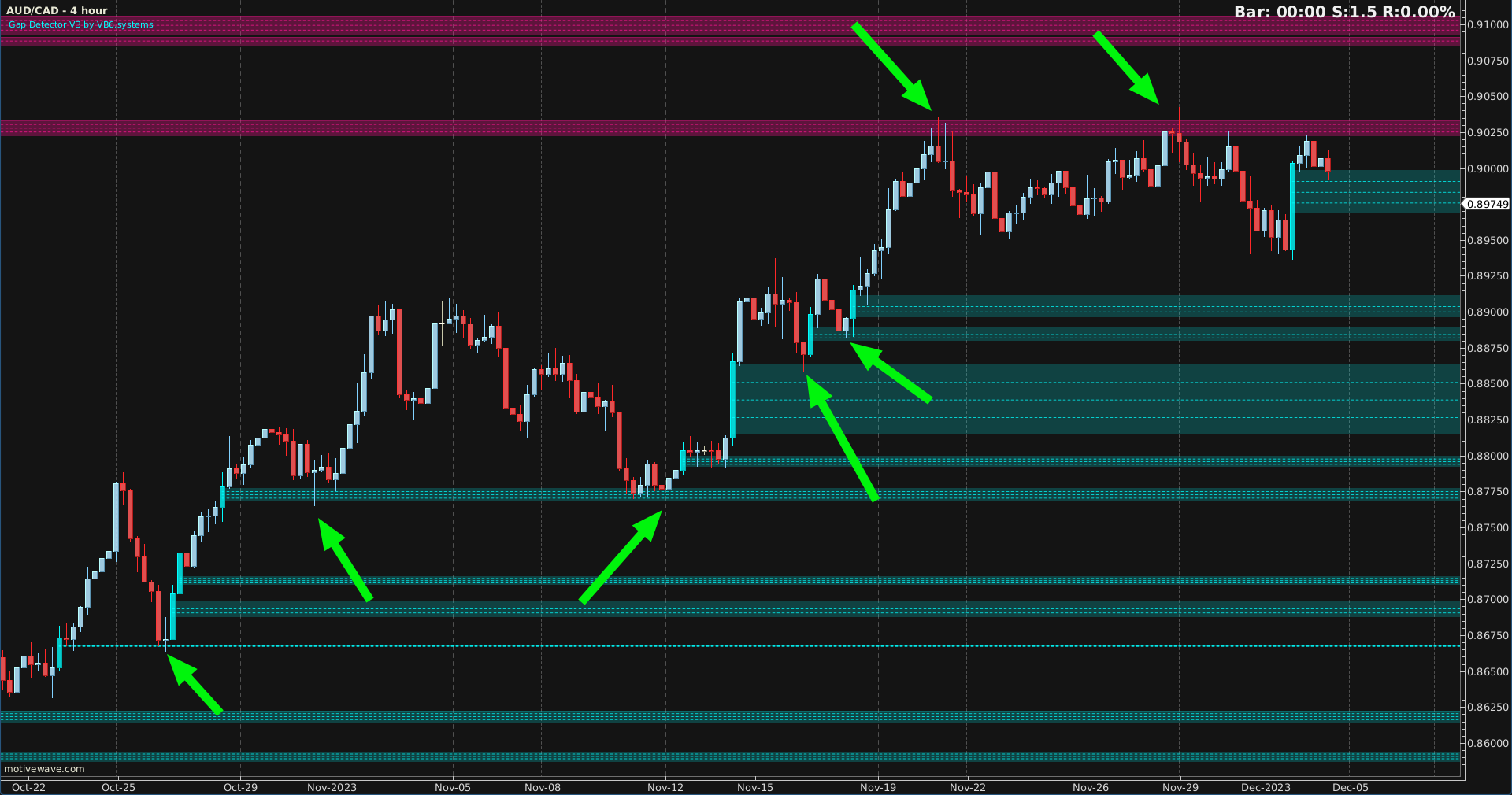

In the next chart, the user decided to invalidate the FVGaps when the Low ‘wicks’ below the 50%-level, and it does, so the Gap is invalidated:

How to import the GapDetector into the MotiveWave Platform ?

We have this covered in our FAQ. Please click here

This Study will find both ‘Fair Value Gaps’ and ‘Unfilled Gaps’, mark them and allow a user to set alerts when a gap is touched or invalidated.

Furthermore, a user can select which level of a candle invalidates a gap (the high / low aka the ‘wick’ or the close)

and at which level a gap should be invalidated (25 %, 50%, 75% or 100%)

click the images to enlarge

click the images to enlarge

What’s included ?

-

-

- Detection of ‘Fair Value Gaps’, defined as “the low of the current bar does not overlap the high of 2 bars before” or “the high of the current bar does not overlap the low of 2 bars before”. Works particularly well for Forex & indices.

- Detection of ‘Unfilled Gaps’, defined as “the gap that exists between last bar’s close and this bar’s open”. Perfect for Futures, stocks, ETF, crypto, ….

- A user can select to show only the Gaps that have not been invalidated yet, or also display the historical ones.

- A user can select which level of a candle invalidates a Gap: either the High/Low (aka the ‘Wick’) or the Close

- A user can also select at which level a Gap should be invalidated: 25% of its total size, 50 %, 75% or 100%

- The colors of the Bars creating a Gap are fully customizable, along with the colors of the Gaps themselves.

- Weight, style and color of the levels inside a Gap can also be adjusted according to taste (and chart background!)

- A user can chose to set alarms for 3 kinds of events, for both Fair Value Gaps and Unfilled Gaps: a Gap (up or down) appeared, a Gap was touched, a Gap was invalidated (according to your own ruleset).

- A user can also use all those alert-values to set MW-alerts, thus creating semi-automated trade setups:

- Last but not least: all these alerts can also be translated into ‘Signals’, allowing time away from the screen (MW will send an email) or the creation of a MW-Strategy, based on Gaps. Creation, Testing and backtesting of Strategies with Strategy Builder (by TradingIndicators.com) is also possible (all GapDetector-values are exported to the Cursor Data Window, so can be selected in Strategy Builder).

- It’s all there !

-

[/vc_column_text][/vc_column][/vc_row]

-

A deeper dive

The ‘Invalidation Options’

Consider the following ‘ENQ’-chart: the GapDetector is set to only invalidate a Gap when a candle closes below the 100%-level of an upwards FVGap. The Low of a candle reaches only below the 50%-level, so the Gap stays ‘alive’: it will continue to be drawn on the chart.

In the next chart, the user decided to invalidate the FVGaps when the Low ‘wicks’ below the 50%-level, and it does, so the Gap is invalidated:

How to import the GapDetector into the MotiveWave Platform ?

We have this covered in our FAQ. Please click here